How to Make a Payment

You can pay your utility bill (water), ambulance bills and general trade invoices securely online using a credit card by visiting https://pay.rmwb.ca. Credit card payments are secured and processed by Moneris (1). Online payments are accepted for utility bills (water), ambulance bills and general trade invoices.

Credit card transactions are processed immediately, but please allow a minimum of 24 hours for the payment to be applied to your account.

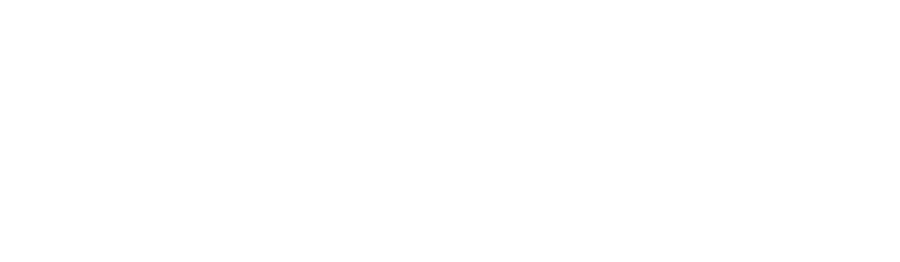

Utility Bills

Utility bills (water) can be paid using a Utility Account Number. These bills look like the following.

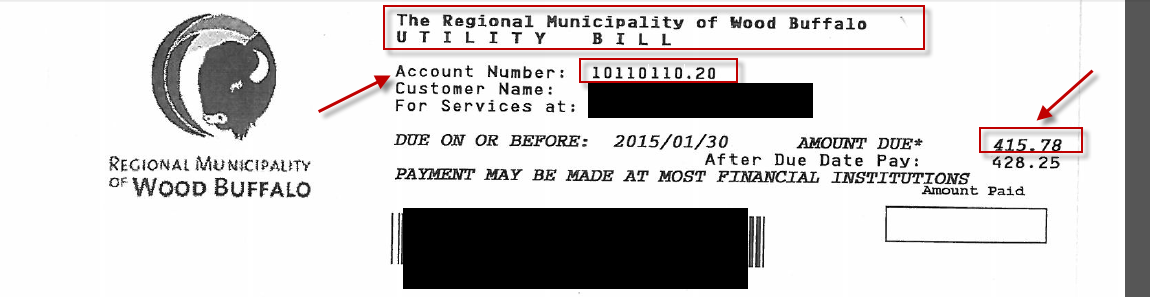

Other Bills

Ambulance bills and general trade invoices can be paid by Invoice Number or Customer Number. These bills look like the following.

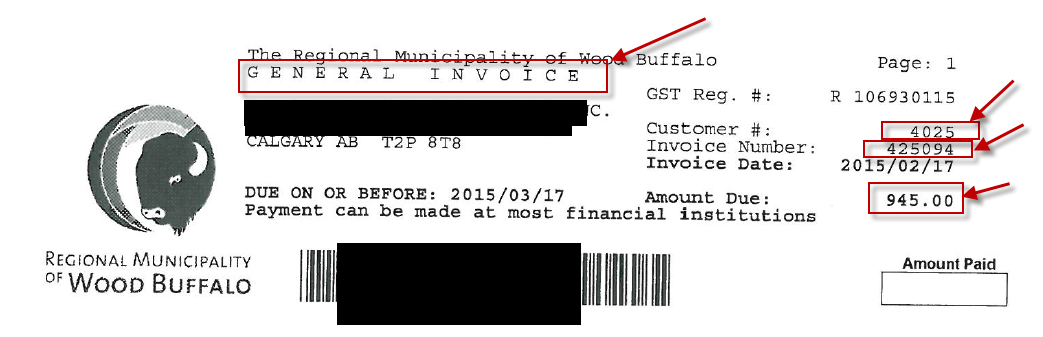

Property Tax Bills

Property Tax bills can be paid using the Account Number, Roll Number, Owner’s Name and Civic Address Details. The bills look like the following.

Steps for paying a Utility Bill

(Water)

- Select the Pay button for Utility Bills

- Enter your Utility Account Number, then click the Get Balance Owing button. For an example of a utility bill, select the link "Click here to view a sample of a bill".

- Ensure the Balance Owing is correct.

- Enter an Amount to pay in the Amount text box. Enter your email. You must enter a valid email to receive your receipt.

- Click the Payment button. This will direct you to the Payment Page. Enter your Card Number, Expiry Date and CVD code. The CVD code is usually found on the back of your credit card.

- Click Pay and your payment will be processed and a confirmation will display. If an error is displayed, correct the Credit Card information or use a different Credit Card.

Steps for paying Other Bills

(Ambulance Bills and General Trade Invoices)

- Select the Pay button for Other Bills

- Enter your Customer Number or Invoice Number, then click the Get Balance Owing button. Online Payments allows you to pay against your Customer Number and carry a positive balance. For an example, select the link "Click here to view a sample of a general invoice".

- Ensure the Balance Owing is correct.

- Enter an Amount to pay in the Amount text box. Enter your email. You must enter a valid email to receive your receipt.

- Click the Payment button. This will direct you to the Payment Page. Enter your Card Number, Expiry Date and CVD code. The CVD code is usually found on the back of your credit card.

- Click Pay and your payment will be processed and a confirmation will display. If an error is displayed, correct the Credit Card information or use a different Credit Card.

Steps for paying Property Taxes

- Select the Pay button for Property Taxes.

- When the www.PaySimply.ca website opens confirm the Payment Recipient shown on the upper right of the screen is WOOD BUFFALO – PROPERTY TAXES (AB)

- Enter the following account details

- email address

- account holder name

- account number

- payment amount

- Click Continue

- Click on the payment option you wish to use

- A review of your payment details and the fees charged will show on the screen for your review and confirmation

- Enter the postal code of the card billing address for the method of payment chosen in the box on the bottom of the screen

- Click Confirm if information shown is correct or click Start Over if you made an error

- Enter the required payment method information and click process to finalize the payment

- When processing is completed the confirmation screen will show showing the payment you have made and an email will be sent to the email address entered in the opening screen confirming your payment has been made

FAQs

RMWB utility bills, ambulance bills and general trade invoices

- What credit cards do you accept? The RMWB accepts Mastercard, Visa and Debit Visa.

- What happens if I overpay on my utility bill? If you overpay on your utility bill, it will be credited to your account and applied against future utility bills. If you have any questions, please call 780-743-7000.

- What happens if I don't pay the full balance on my account? Will I be charged a penalty? Regardless of how a resident chooses to pay their bill, any outstanding balance as of the due date is subject to penalty. Penalties are calculated at 1.5% per month.

- How long does it take the RMWB to process online payments? Can I still pay my bill on the due date? The transactions are processed immediately but please allow a minimum of 24 hours for the payment to be applied to your account.

- I made my payment online but didn't receive a receipt. How can I be sure my payment went through? If you have any questions about your utility, ambulance bill or general invoice, call 780-743-7000.

- I prefer not to pay my bills online. Are there other methods of payment I may use instead? Bill payment by the online portal is the newest payment option available but it's only one of many methods. Residents can continue to pay these bills at any Canadian chartered bank, through telephone or internet banking, by mail, by pre-authorized Utility Payment Plan (PUPP) for automatic debit from your account, or by Mastercard, Visa or Debit Visa in person or by telephone at 780-743-7020.

- I am concerned about security. Is this a secure way to pay my bill? Yes, the online payment portal is a secure way to pay your bill. For more information on this Moneris service, please refer to: https://www.moneris.com/en/Support/PCI-Data-Security/PA-DSS

- When I use this portal to pay my bill, is my credit card information kept on file? No. This is a one-time payment only. This is not a pre-authorized payment service.

- Am I able to access previous payments I've made using this online portal? No. This is a one-time payment only. This is not a pre-authorized payment service.

RMWB property taxes

- What credit cards are accepted when paying property taxes? The payment platform PaySimply.ca accepts payments from many merchants. Please refer directly to PaySimply.ca for the current list of credit cards that they accept. www.PaySimply.ca

- What happens if I overpay on my property tax bill? If you overpay on your property tax bill, it will be credited to your account and applied against future property tax bills. If you have any questions, please call 780-743-7000 or 1-800-973-9663 (Toll-free).

- What happens if I don't pay the full balance on my account? Will I be charged a penalty? Regardless of how a resident chooses to pay their bill, any outstanding balance as of the due date is subject to penalty. For information on the penalty rates charged on outstanding property taxes, please visit Penalty Information.

- How long does it take the RMWB to process property tax credit card payments? Can I still pay my bill on the due date? The transactions are processed immediately but please allow a minimum of 5 business days for the payment to be applied to your property tax account.

- I made my payment online but didn't receive a receipt. How can I be sure my payment went through? If you have any questions about your property tax bill payment, call 780-743-7000 or 1-800-973-9663 (Toll-free).

- I prefer not to pay my bills online. Are there other methods of payment I may use instead? Bill payment by the online portal is the newest payment option available but it's only one of many methods. Residents can pay these bills at any Canadian chartered bank, through telephone or internet banking, by mail, by pre-authorized Tax Installment Payment Plan (TIPP) for automatic debit from your account, or by Mastercard, Visa or Debit Visa in person or by telephone at 780-743-7000.

- I am concerned about security. Is this a secure way to pay my bill? Yes, the online payment portal is a secure way to pay your bill. For more information, visit PaySimply.ca.

- When I use this portal to pay my bill, is my credit card information kept on file? No. To use this service, visit PaySimply.ca and make your payment. To learn more about this service and how it works, visit their website.

- Am I able to access previous payments I've made using PaySimply.ca? No. As there is no sign in needed to use PaySimply.ca prior payments are not tracked. For more information, about this service and how it works, visit their website.

- Can I stop my monthly automatic property tax payments and pay the full amount by credit card once a year? Yes. To do this, you must provide written confirmation that you would like to stop your monthly payments. For more information, contact 780-743-7000 or 1-800-973-9663 (Toll-free).

- Why does the property tax payment option take me to PaySimply.ca? Residents who choose to pay their property taxes by credit card will be redirected to PaySimply.ca. This platform will accept the property owners' payments and then transfer those funds to the RMWB.

- Why am I charged a fee to pay my taxes by credit card? Credit card companies charge a fee to process payments. In this case, the fees associated with paying property taxes by credit card could cost the Municipality millions of dollars annually. The RMWB, like most municipalities, is not in a position to absorb the cost of these credit card fees. By providing a user pay service, we’re ensuring that property owners can choose to enjoy the convenience of paying by credit card if they wish but the cost does not impact all residents.

- Do other municipalities use PaySimply.ca for online payments? Many other municipalities, including Calgary, St. Albert and Fort Saskatchewan, educational institutions such as University of Alberta and other levels of government such as Government of Alberta and Canada Revenue Agency currently accept PaySimply.ca as a payment option.

(1) Moneris is a credit card processor and payment company https://www.moneris.com/